Five fintech trends to look out for in 2022 and onwards

Technology is evolving at an unimaginable pace. There have been massive innovations in the past decade and what’s exciting is that you can expect more breakthroughs in the coming years.

Technological progress touches nearly every industry. However, the technological development in the financial sector and the introduction of fintech have been nothing less than a quantum leap.

Financial Technology, or fintech, provides remarkable opportunities and benefits for businesses to grow. With the emergence of the COVID-19 pandemic, the fintech industry experienced phenomenal growth.

Reports show that global fintech investments touched $44 billion in 2020 and increased by 144% in 2021. Studies also predict that the fintech market will expand to $31.5 billion by 2026.

Fintech trends are gaining traction, and there is no doubt that fintech will be the next big thing. That said, let’s look at some top fintech trends to look out for in 2022.

- Blockchain

The most extensive fintech development to date has been blockchain technology. Blockchain is the force behind the evolvement of bitcoin and other cryptocurrencies.

Cryptocurrencies alone helped blockchain grow by a tremendous amount. When first invented, bitcoin cost $0, but today it costs more than $23,000.

Even though bitcoin trades differently on each exchange, it still experienced outstanding progress globally.

For instance, the BTC/CAD might vary from BTC/USD, but the overall global growth remained persistent. If that doesn’t show progress, we are uncertain what does.

However, contrary to popular belief, blockchain supports many applications other than crypto. Cross-border payments, supply chain monitoring, real-time IoT operating systems, and peer-to-peer transactions are some examples of applications using blockchain.

NFTs and DeFi are two more remarkable developments that might change the face of finance.

Blockchain certainly carries more potential than we are experiencing today. It is a powerful technology that needs to overcome some challenges before it becomes widespread.

- The internet of things (IoT)

The IoT industry is continuously giving the fintech sector an exciting boost. IoT can act as a mobile point-of-sale system and a cybersecurity tool that can enhance security and encrypt payment information.

Moreover, connected wearables perform several essential tasks in the fintech industry. For example, the mobile banking application enhances convenience, helps monitor customer behavior, and improves decision-making.

The increased involvement of IoTs in the fintech industry will lead to the wearables market growing by more than $100 billion by 2028.

IoTs ensure prompt customer assistance, indoor customer navigation, and on-site line management. Moreover, IoTs allow real-time customer data monitoring to help make strategic decisions and improve the entity’s performance.

The Internet of Things is revolutionizing payment methods. Digitalized payments are more convenient, secure, and hassle-free.

IoT devices are authentic and safe. They increase business efficiency through automation and help reap the benefits of insurance claims.

Furthermore, IoTs can assist banks in leveraging peer-to-peer technologies to fulfill the constantly altering demands of customers and enhance effectiveness.

- Artificial Intelligence

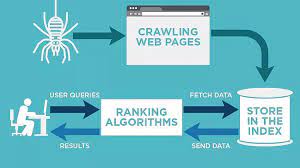

Artificial Intelligence is perhaps the most known innovation in the fintech industry. However, many people are still unaware of AI’s true potential. AI is an excessively robust technology that can help overcome challenges in unimaginable ways.

Artificial Intelligence uses intelligent algorithms that improve many processes of banks and other financial companies.

AI studies the behavior of users and instantly detects unusual behavior and occurrences. It helps in preventing scams and catching fraudsters. Integrating AI tools into business processes significantly reduces human error, more robust security, and improves customer service.

Moreover, AI ensures regulatory compliance and auditing, provides valuable insights, and helps achieve reliable credit stores.

AI also creates virtual assistants and chatbots to help customers. These chatbots are available 24/7 to assist customers with any problem they might be facing.

AI is taking fintech a step forward and helping it grow massively. If you want to start a fintech business, investing in a few AI tools is necessary.

- Augmented / Virtual Reality

Augmented and Virtual Reality is another rising fintech trend taking over the market uniquely and excitingly.

Using VR tools to invest in stock or trade currencies has been incredible. It provides immersive experiences and helps track real-time behavior.

VR applications simplify payment processes, help create stronger emotional bonds, and improve training. They are unique inventions that instantly attract customers.

However, you must understand that the real world is significantly different from the virtual world; customer behavior might differ in the virtual world.

Testing waters before diving deep into the digital world is imperative. However, you can use VR tools to collect data and information regarding your clients.

Equipping VR with clients’ habits and concerns lowers the risk of losing consumers’ attention. You create a convenient spot for interaction with your potential customers and prevent them from slipping away.

VR and AR are becoming increasingly famous technology. A study showed that VR’s market value reached $15.81 billion in 2020, and experts predict it to grow by 42.5% in 2030.

- Regulatory technology

In simplest terms, regulatory technology combines technology with regulations. It is crucial to understand that specific laws and rules bind technologies, and all users must abide by each.

Usually, companies maintain their accounting records, submit them to regulatory authorities, and wait for data and legal confirmations. It is a tedious process and is worse for companies operating in international markets.

RegTech is a platform that helps overcome such issues. It organizes workflow and helps companies meet regulation standards.

RegTech streamlines processes, improve risk management and enhances time and cost efficiency.

Moreover, it centralizes regulatory filings, improves accountability, ensures accuracy, and boosts trust in your brand.

RegTech is a combination of special software that monitors data security, automates repetitive tasks, and warns bank employees about scams.

In short, regulatory technology encourages an organization to comply with industry regulations. The penalty for non-compliance could be worth millions of dollars. For example, Google’s non-compliance fine was almost 50 million euros.

Wrapping up

Fintech is rightfully becoming a defining trend in today’s highly tech-intensive world. It makes funding more obtainable, boosts efficiency, speeds up the payment process, and improves risk management.

Many financial companies are changing their structure to become more fintech-inclusive. Fintech is more customer-centric and innovative.

It streamlines complex financial information and makes it more attainable to customers. Besides, fintech tools and systems help reduce cost, increase revenue, advancing security.

Several studies confirm that the fintech industry will boost employment rates and improve the job market significantly in the future.

A few more challenges to overcome, and you’ll see the magic that fintech will bring to this world.