AML Solutions – Putting An End to Previaling Financial Crimes

Financial institutions are in a continuous struggle in restricting criminals’ access and providing security to legitimate customers. Criminals use advanced methods to open accounts, hide the sources of their funds, and launder money. For instance, they keep their UBO’s information confidential, use forged documents, and camouflage identities. This brings reputation damages to financial institutions and increases the chances of non-compliance and hefty fines.

Therefore, financial institutions need robust AML solutions to accurately verify their customers. Keeping in view the rise in financial crimes, authorities are revamping AML compliance standards like 6AMLD. These regulations mandate financial institutions especially banks to cross-verify customers’ identities, keep track of their activists, and report suspiciousness in time. The blog covers how AI-powered AML solutions help financial institutions to stay compliant with regulations.

AML Verification Solutions – A Detailed Overview

Regulatory authorities enforce Anti Money Laundering (AML) laws to identify criminals and prevent them from moving their ill-gotten funds into the financial systems. According to Shufti Pro News, criminals are using advanced money laundering schemes to fake their source of funds. This way they make their black money look legitimate. Therefore, regulatory authorities monitor financial institutions to ensure they are restricting these criminals and their illicit activities. Moreover, mandates institutions to obtain accurate information about their customers and keep track of their transactions.

These regulations prominently include 40 recommendations by FATF, The Bank Secrecy Act, 6AMLD, and POCA. as per these laws, banks and financial institutions should not leave monitoring unattended and report suspiciousness in time to authorities. This way, enforcers can take required actions timely and secure financial institutions from threats like money laundering and terrorism financing.

AML Security Systems – Prominent Methods to Safeguard the Financial Institutions

Financial institutions are facing an increase in cases of money laundering and terrorism financing. This leads to reputational damages, non-compliance, and heft penalties. Criminals use methods like identity theft, hidden UBOs, and others to carry out their illicit activities. Financial institutions like banks, real estate, insurance companies, and investment firms are the most at risk of falling prey to criminal threats.

However, if they have authentic and robust verification solutions in place, there will be fewer chances of fraudulent registrations. AI-powered AML verification not only helps financial institutions to provide security to legitimate customers but also keeps track of their activities to maintain databases. More benefits include:

Identification of Ultimate Beneficial Owners (UBOs)

UBOs are the entities who own the transactions. Criminals often keep their UBOs’ information confidential so that their source of funds can not be traced. This way they can launder money into banks. Therefore, financial institutions need robust AML monitoring solutions to accurately verify the UBOs. As the regulations identify, these are the entities who own 25% of shares in the company.

Moving on, the financial institutions should validate the UBOs at the time of account opening when they are performing Know Your Customer checks. Along with this, financial institutions should also keep track of customers’ and firms’ activities. This involves continuous follow-up on changes regarding UBOs. hence, the financial institutions need to integrate robust and seamless AML solutions to that they can overcome the loopholes in time.

Enhanced Due Diligence

After the identification of UBOs, Enhanced Due Diligence (EDD) is equally important. It provides a comprehensive analysis of companies’ partners, structures, and risks they possess. EDD involves the authentic customers’ identity and addresses verification alongside evaluating the risk category. It further involves the following procedures:

- Risk-based approach

- Monitoring of transactions

- Screening against adverse media and sanction lists

AI-powered EDD enables financial institutions to build a holistic view of customers and firms. This includes identification of structures, cross-verification of backgrounds, and monitoring of activities. Shufti Pro Funding indicates that this way financial institutions can prevent unforeseen criminal threats and report suspiciousness to authorities in time.

Continuous Monitoring of Transaction

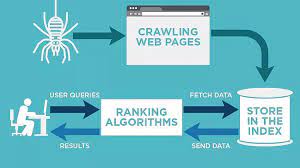

Financial institutions and banks hold billions of ongoing transactions. Discrepancies, inaccuracy, and lack of tracking can lead to money laundering and other financial crimes. Therefore, regulatory authorities oblige financial institutions to record and monitor these transactions. In the case of traditional methods, financial institutions can expose themselves to criminal threats because these are prone to various errors.

For improved security and follow-up, financial institutions need to employ AI-backed MAL screening solutions. They not only reduce operational costs and saves time but also provide efficiency in keeping track and traces of transactions.

In a Nutshell

Financial institutions are increasingly falling prey to criminal threats and activities like money laundering and terrorist financing. Therefore, regulatory authorities are imposing strict regulations on banks and other financial institutions to verify their customers, monitor transactions, and report suspicious activities in time. For this, they need authentic AML checks in place with improved customer verification processes. AI-powered AML solutions are the financial institutions’ go-to solutions for mitigating criminal activities and onboarding legitimate customers.